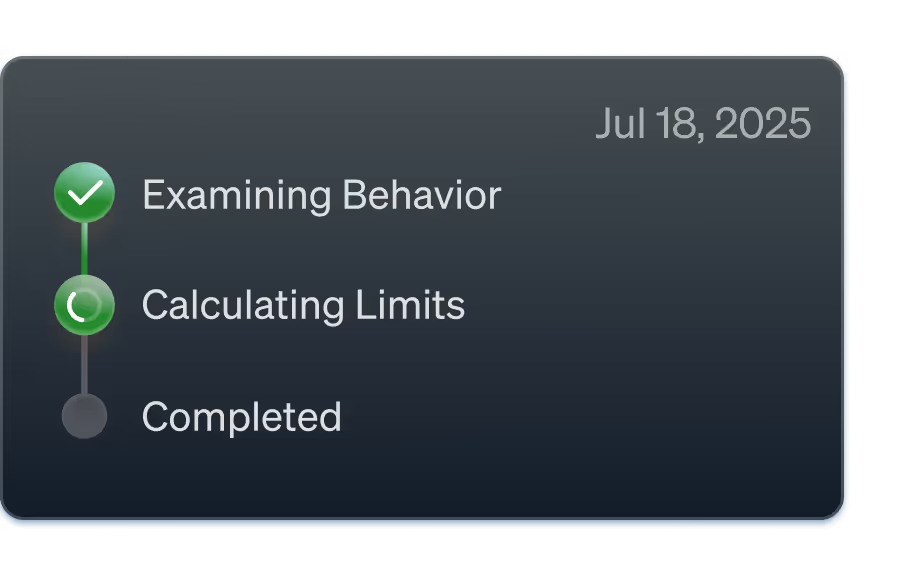

sent automatically

sent automatically

Proven Impact Across Credit Operations

66%

Reduction in credit

decision time

90%

Reduced approval

cycle time

71%

Less time spent

searching for data

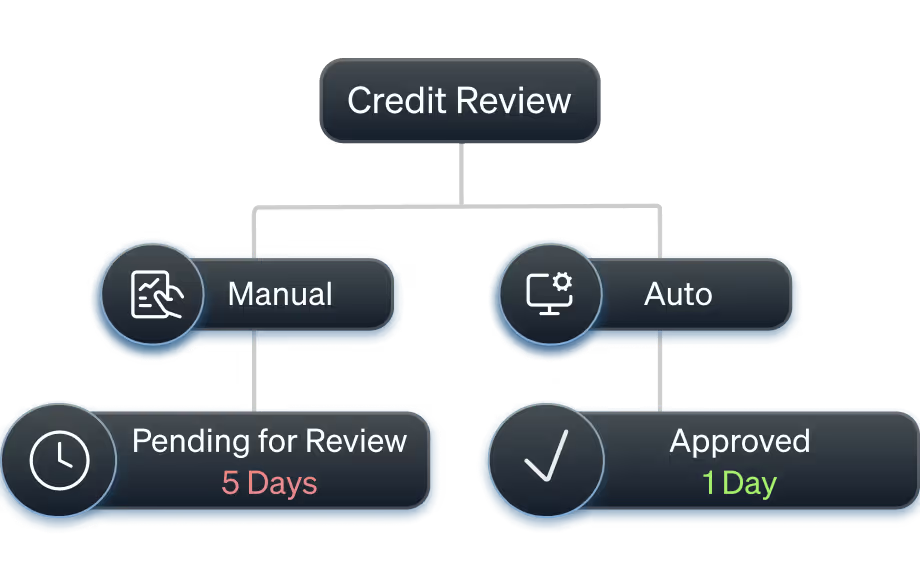

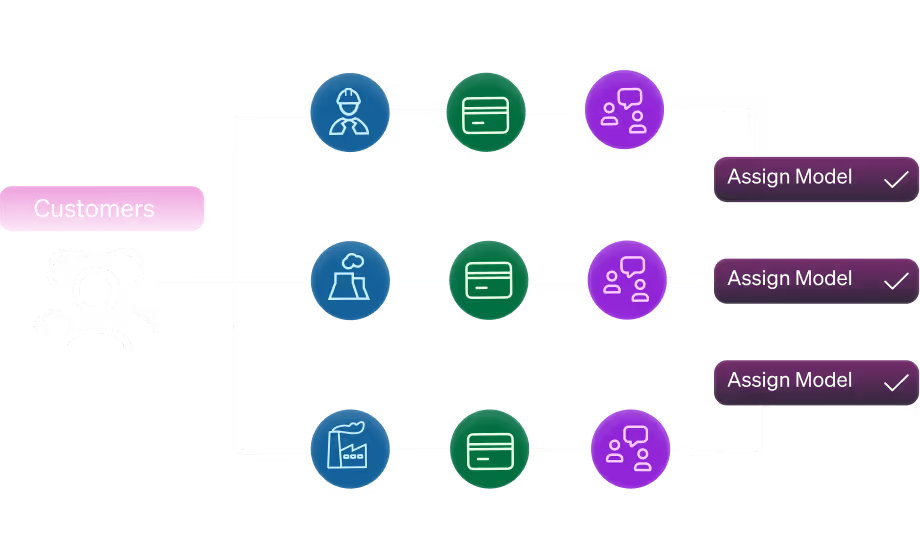

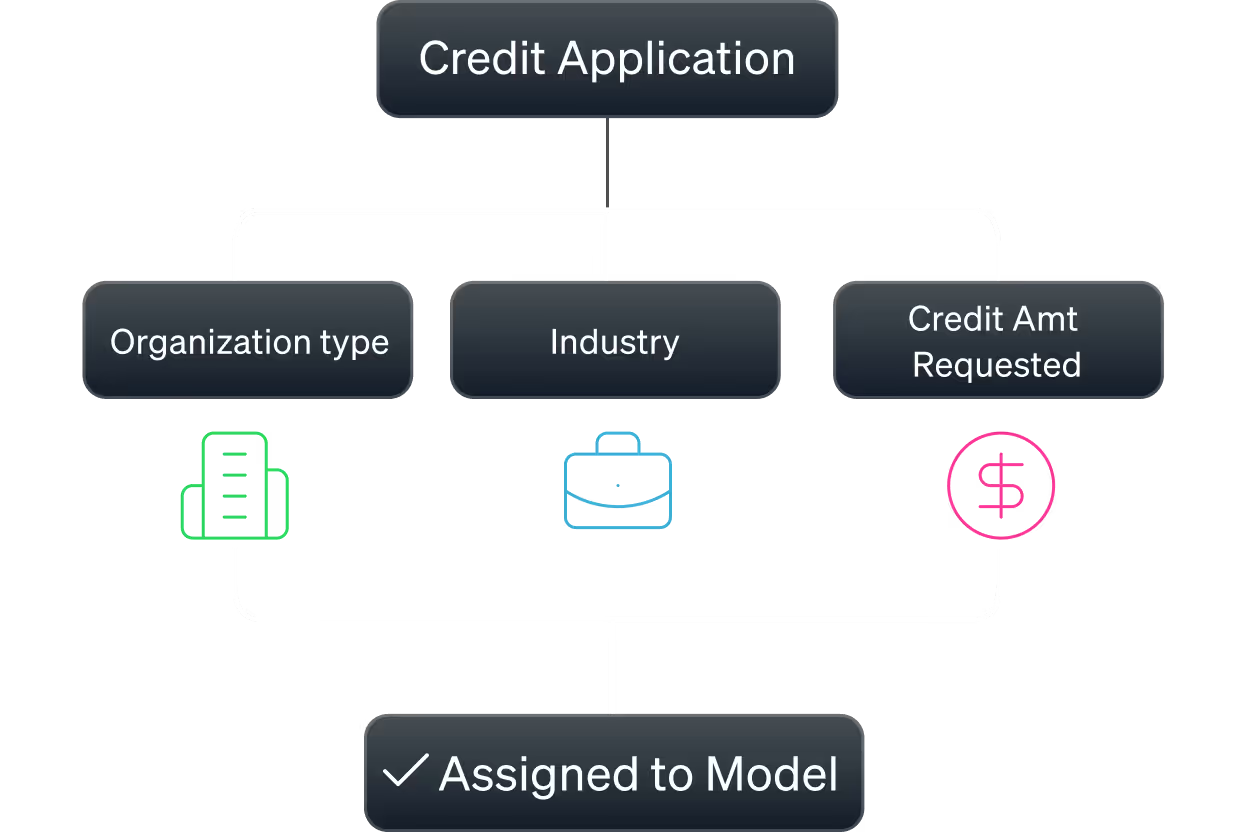

Customize scoring models across customer segments

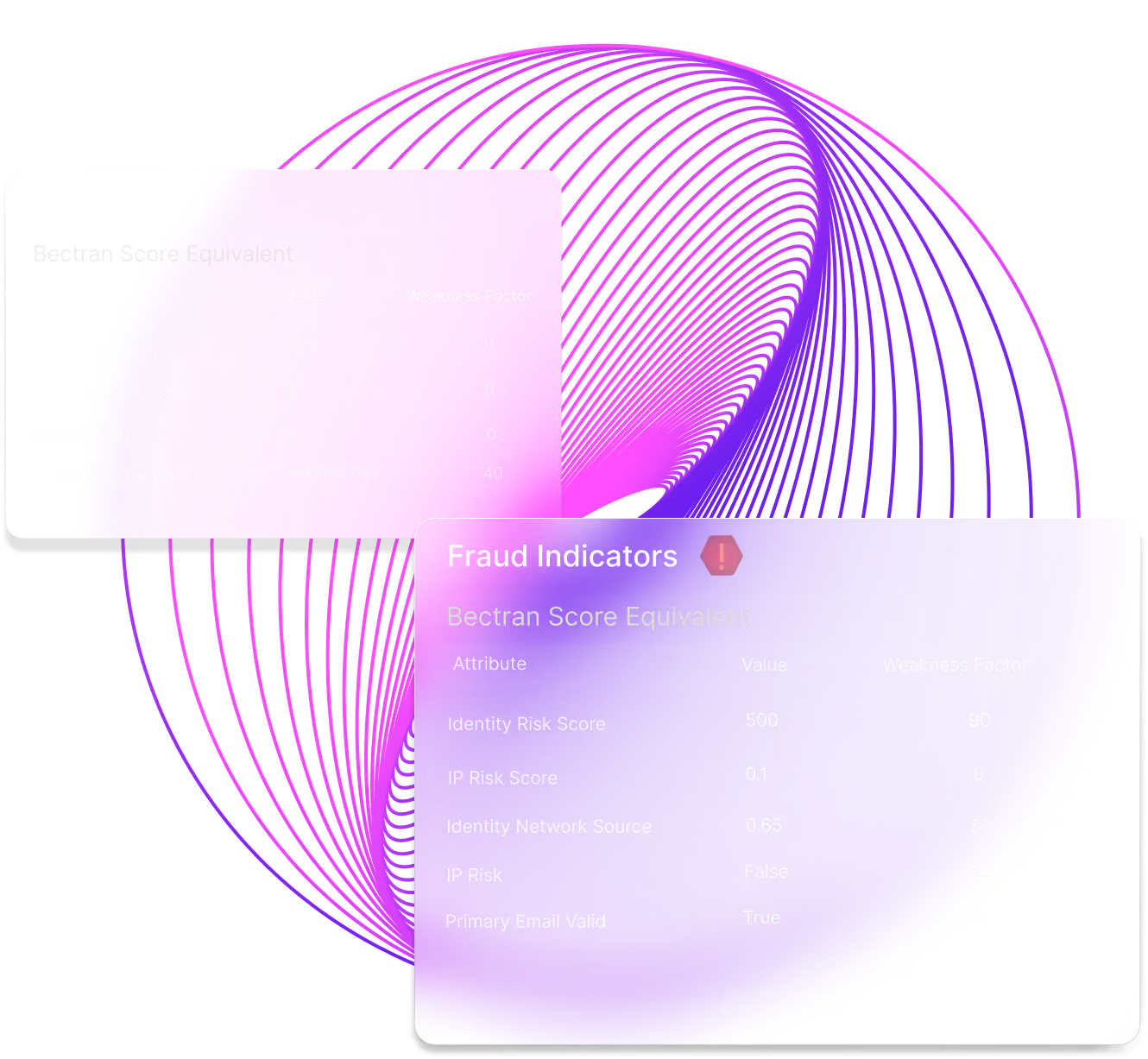

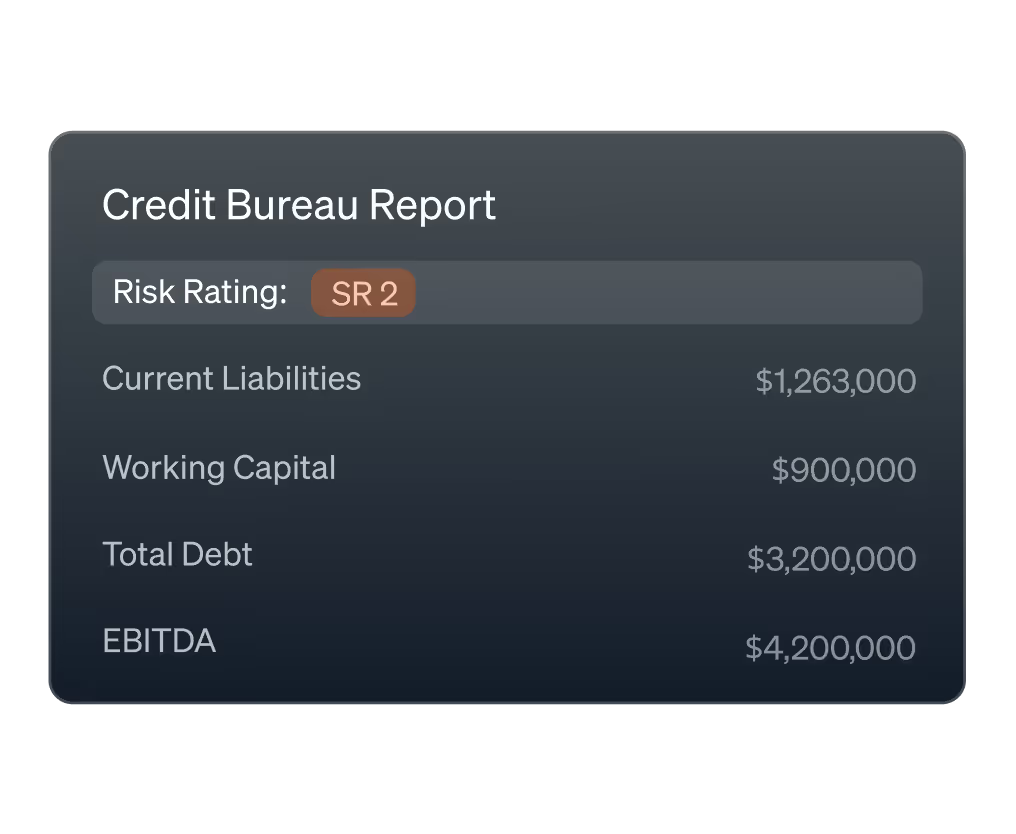

Analyze publicly available financial and credit data

Monitor creditworthiness

and risk in real-time

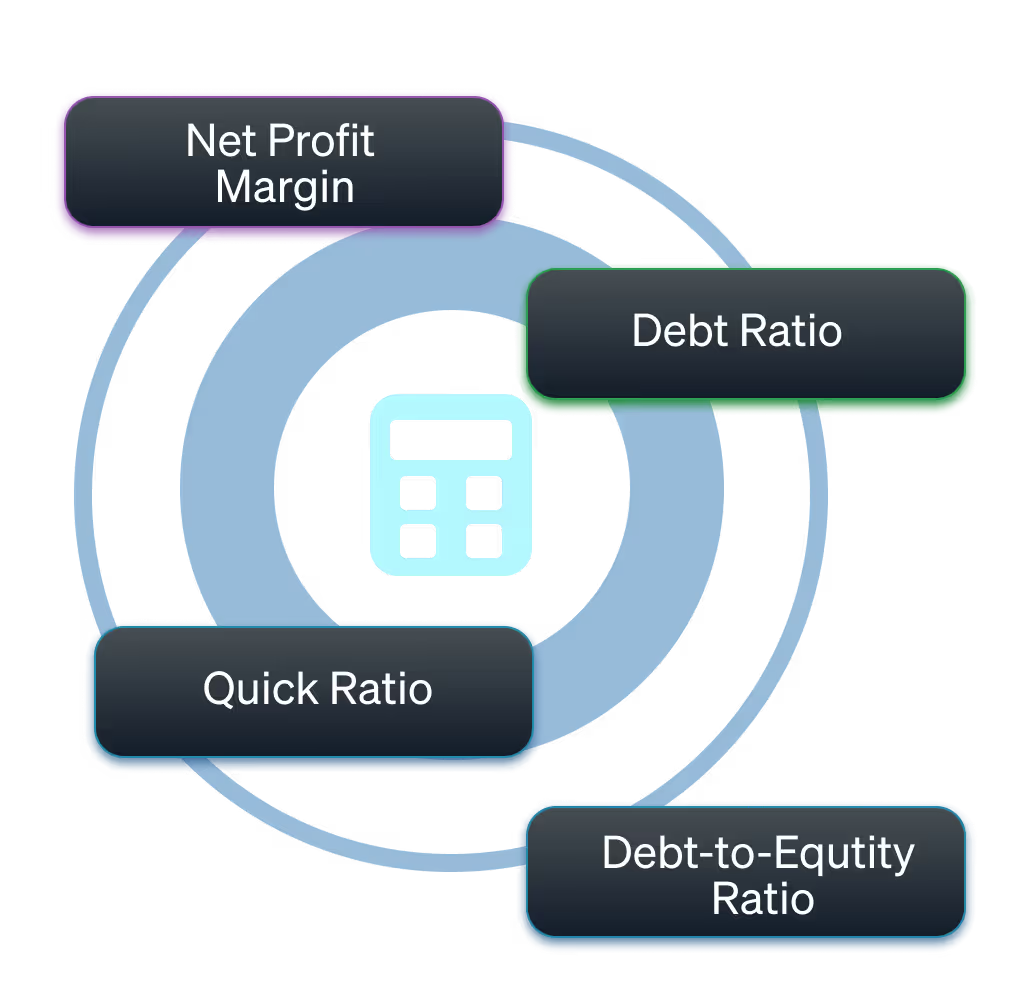

Instantly calculate financial ratios

Receive reports of suspicious activity

What our Clients say

"We collect money faster. Compared to last year, we're $10 million ahead, which is substantial in our business."

"It's been a very positive experience. Not only with implementation, but with custom modifications or changes down the road... we have a very good partner in Bectran that listens to and understands our needs."

"Bectran uses advanced logic to connect with our customers and give them more information...[Bectran] has been quicker and easier for our customers."

"The technical team met with us on multiple occasions. They made time available, even during our working hours, in order to implement the solution."

"We're not a cookie-cutter credit department... we were very impressed with how Bectran stuck with us, even with the curveballs we threw."

Assess Risk with Clarity and Confidence.