Introducing Bectran Intelligence Lab — AI tools for credit, risk, and collections.

Explore the toolkit →AI-Powered Credit Optimization

Automate approvals with speed and precision, all while staying fully aligned with your credit policy.

Intelligence Meets Velocity.

From the initial application to regular customer maintenance, AI streamlines the O2C process — helping your team assess creditworthiness with greater confidence.

Tailored Risk Approach

AI-driven credit applications dynamically adapt to your unique risk profiles. Machine learning identifies patterns in real-time and captures the most predictive data points, improving decision precision with every submission.

A Window Into Review

Intelligent LLMs pre-screen submissions for anomalies and flag outliers before human review. Intelligent triage systems prioritize high-risk cases and provide summaries to reduce manual effort and speed up review cycles.

Document Collection and Reporting

Seamlessly integrated into the platform, documentation and credit bureau reporting eliminates the need to navigate multiple external sources or third-party contacts.

Layered Automation

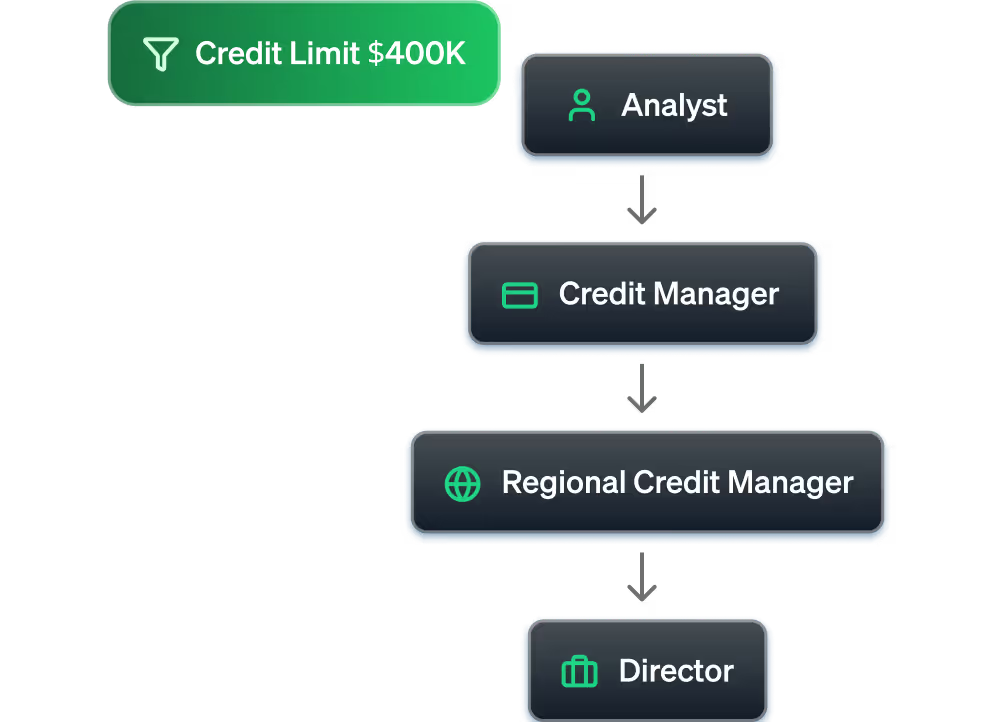

Mirror your existing approach hierarchy with multi-layer approval. You can fully automate the entire process with Instant Decision Manager.

With end-to-end AI automation, credit teams can create intelligent, self-evolving decision models for trusted customer segments — like repeat buyers, cash customers, or low-risk profiles. These models continuously learn from outcomes, eliminating unnecessary approvals and accelerating credit decisions with each cycle. The more decisions Bectran makes, the smarter and faster it gets.

Establish your own criteria by utilizing real-time data, pulled from bureau and fraud detection reports. Bectran’s AI-powered models analyze each data point to generate a single, comprehensive risk score, empowering credit managers with a thorough scope of customer risk, all from one glance.

Configurable to your organizational hierarchy, automated approval sequencing ensures that requests are always routed to the appropriate decision-makers. Not only does this eliminate the need for lengthy email chains, it maintains accountability, building trust in your credit process.

Precision at Every Step

From routine approvals to critical exceptions, keep your decision-makers aligned and informed.

Empower Decision-Makers

Give approvers the exact information needed, when they need it.

Reduce Approval Fatigue

The automation of routine approvals enables your team to focus on exceptions that require more discerning judgement.

Keep Teams Aligned

Seamless routing ensures that all team members are consistently informed, fostering natural collaboration.

The Story Behind the Decision

With every step tracked, timestamped, and accessible, there’s never a question of what or why an action occurred.

Grow Without Constraint

As volume increases, routing logic scales with you — keeping approvals quick, clean, and under control.

Explore the AI tools behind faster processes, sharper insights, and better outcomes

across credit, collections, and accounts receivables.