Introducing Bectran Intelligence Lab — AI tools for credit, risk, and collections.

Explore the toolkit →Credit Review Automation

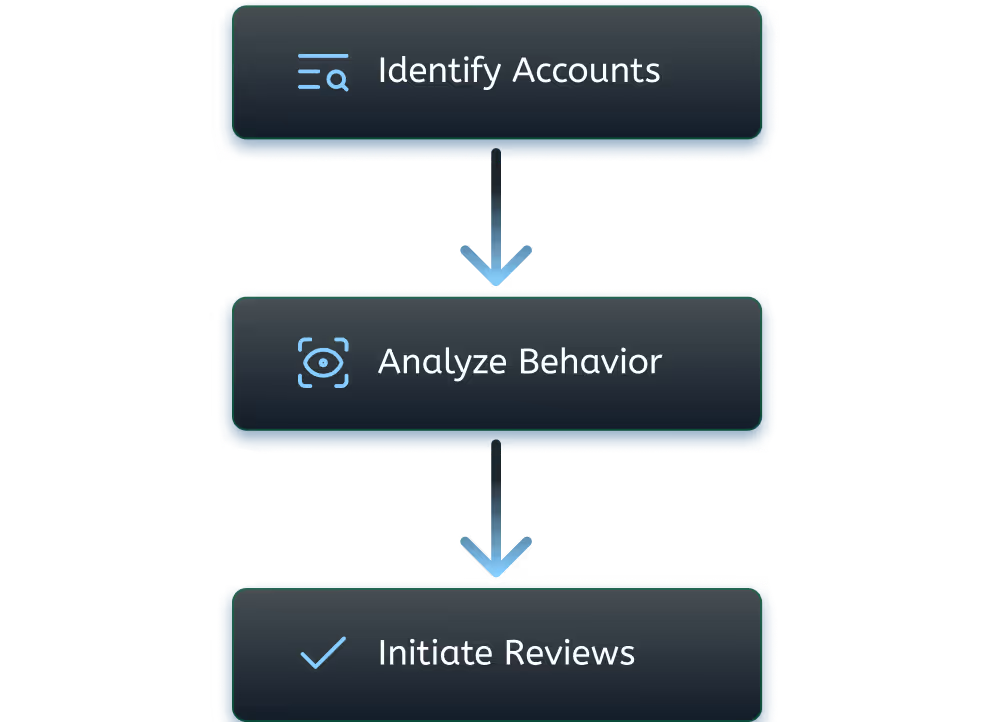

Adjust credit limits & terms with speed and accuracy to minimize default risk and accommodate growth in customer transactions. A model-based credit and account review automation that triggers on governing corporate credit policy.

Activate High-Confidence Growth

Use real-time performance signals to identify and elevate accounts ready for credit expansion.

Consistent, efficient, and powerful at scale.

Recognize Top Performers

Automatically flag accounts with excellent payment behavior, increasing visibility for customers ready to take on more credit.

Scale Credit Limit Growth

Apply consistent criteria across thousands of accounts to streamline credit increases without manual intervention.

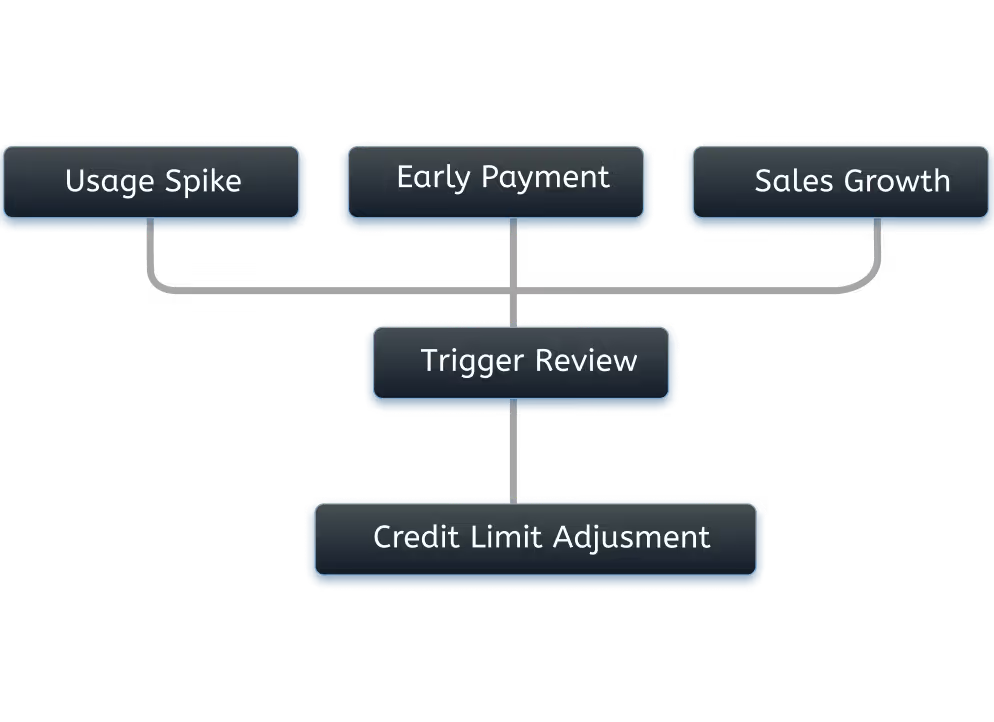

Adapt to Customer Momentum

Trigger reviews based on rising order volume, improving cash flow, or consistent early payments.

Reward Reliability, Instantly

Instant decision manager (IDM) auto-approves limit increases for customers who meet your set criteria.

Manual review cycles slow down growth. When credit evaluations follow fixed timelines, even your most reliable customers can end up waiting too long for the limits they've earned. With behavior-based triggers in place, reviews now happen when customers actively show signs of stronger creditworthiness — so credit keeps up with performance, not the calendar.

Tailor your review models to match your credit policy — down to the detail. Whether it’s credit utilization, payment speed, order volume, or regional trends, you control exactly what triggers a review. Predictable, high-performing accounts can move forward with auto-approvals, while complex cases route to manual review with all supporting data in place. Every decision is logged and auditable, so credit expansion remains fully controlled, even at scale.

Continuously monitor account behavior to spot signs of creditworthiness in real-time. Usage trends, early payments, and sales activity automatically trigger reviews — strengthening customer relationships while keeping your credit operation dynamic and responsive.

Built for Teams Who Want Speed and Control

Align credit decisions with customer behavior, business goals, and cross-functional priorities to fuel sustainable, scalable growth.

Avoid Growth Impediments

Prevent unnecessary order holds and slow approvals by reviewing limits in advance of customer needs.

Drive Strategic Expansion

Target credit growth for customers in key product lines, regions, or market segments.

Reinforce Positive Payment Behavior

Use credit limit increases to reward customers who pay early, consistently, or exceed their terms expectations.

Strengthen Cross-Functional Alignment

Connect credit with sales and AR teams by using shared metrics to guide when and how limits are increased.

Improve Credit Line Visibility

Track the volume, timing, and approval rates of proactive limit increases across customer segments and regions.

Explore faster processes, sharper insights, and better outcomes across credit, collections, and accounts receivables.