Introducing Bectran Intelligence Lab — AI tools for credit, risk, and collections.

Explore the toolkit →Order Hold Management

Accelerate order releases, minimize default risk, and boost working capital through our suite of industry acclaimed, flexible, and configurable order hold management AI models.

Organized Holds, Faster Releases.

Traditional order holds often mean slower processing and unpredictable outcomes. By replacing reactive processes with real-time, multi-layered risk evaluation, your team can clear holds faster — without giving up oversight or control.

Reduce Review Time by 80%

Automated risk checks and cascading decision models handle the majority of order evaluations without human intervention.

Reduce Release Time

Integrated workflows trigger real-time order releases based on dynamic, risk-adjusted criteria, and customer behavior patterns.

Lessen Risk Exposure

Stricter rules on unsecured accounts and real-time exposure analysis help prevent overextension.

Protect Your Pipeline

Resolve holds in real-time to avoid missed delivery windows and maintain momentum on high-value accounts.

With a tiered model in place, each order is assessed through multiple layers of criteria like credit limits, payment behavior, and account type. If it doesn’t pass the first check, it moves automatically to secondary and tertiary models — providing more precision, more control, and fewer avoidable delays.

Bectran utilizes connected intelligence to apply stricter risk criteria to unsecured orders, while allowing more leniency for secured ones. This ensures that financially-backed transactions are never unnecessarily delayed, while outliers are held to higher standards.

Armed with this model, users can customize how aggressively they manage risk — optimizing customer satisfaction without exposing the business.

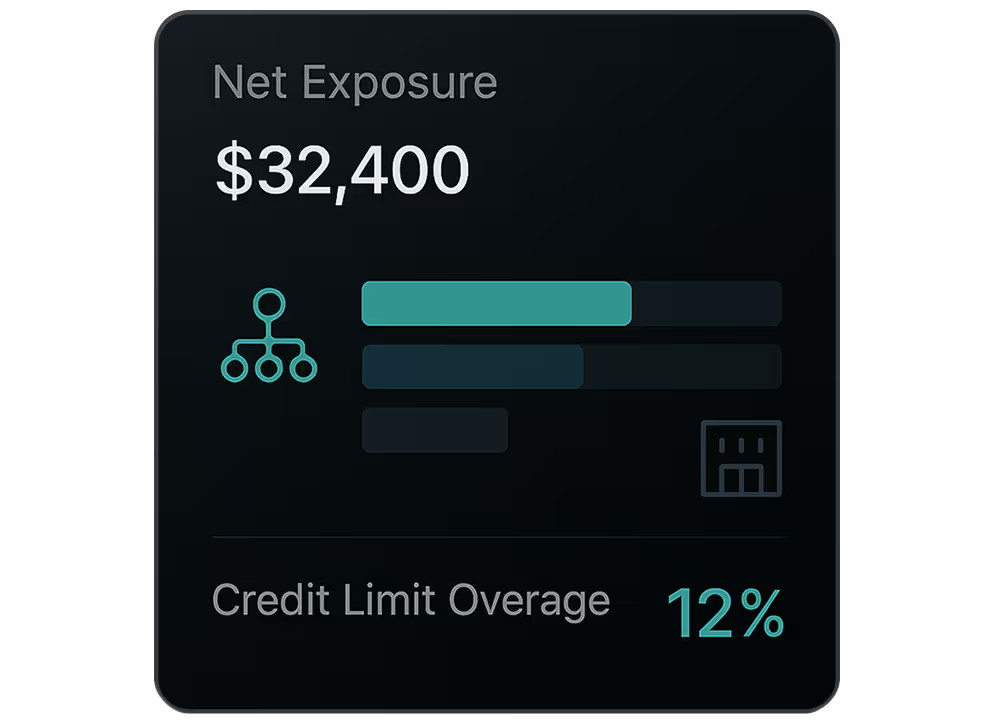

Analyze complex hierarchies and credit limit utilization across sub accounts in real-time, generating a comprehensive understanding of total exposure and making accurate release decisions faster than a human can. Exceptions are flagged and routed to the portfolio owner.

Credit teams can track credit limit overages down to the percentage, prompting timely, accurate responses. Whether it’s one high-volume customer or a group of riskier sub-accounts, you’ll know exactly when to step in — and when to release.

Built for Teams That Move Fast

Drive smarter collections with automation, segmentation, and real-time tracking — all in one centralized platform.

Dynamic Risk Rules

Apply tailored criteria based on order type, account history, and payment behavior.

Parent-Child Aggregation

Calculate net exposure across job and main accounts, ensuring comprehensive portfolio visibility.

Secured vs. Unsecured Logic

Enact stricter controls over unsecured orders paired with flexible logic for financially-backed ones.

Automated Model Checks

Failed orders are re-evaluated daily, unlocking future release opportunities.

API-Driven Workflow

Integrate seamlessly with your ERP or order hold system to trigger holds and release in real-time.

Explore the AI tools behind faster processes, sharper insights, and better outcomes

across credit, collections, and accounts receivables.