Introducing Bectran Intelligence Lab — AI tools for credit, risk, and collections.

Explore the toolkit →Portfolio Insights

Manage, optimize, and gain full visibility into your AR landscape with advanced portfolio segmentation, team accountability, and credit quality tracking across multiple performance metrics.

Track What Matters

Group accounts by industry, credit risk, geography, and more — allowing your team to focus on the right accounts with the right strategies. This reduces days outstanding and maximizes collection efficiency.

Forecast and Track Risk

Leverage historical data and predictive analytics to build forecasting models for AR performance. Perform detailed reviews to identify and prioritize high-risk accounts within your portfolio.

Export Portfolio Insights

Export detailed account insights such as risk scores, payment behavior, credit usage, and collection status into any format.

Portfolio Management

Group accounts by credit risk, payment behavior, industry, or other factors. Develop and implement targeted strategies to reduce risk and improve overall portfolio health.

Team Impact

Ensure each portfolio has a clear owner. This reduces confusion, improves follow-through, and makes performance easier to track. Monitor results, balance workloads, and drive accountability across the team.

Detailed AR Reporting

Receive account-specific, detailed reporting regarding your portfolio. Track credit quality, DSO, aging, and more to measure the impact of portfolio-wide collection strategies.

Task Tracking

Escalation workflows ensure your team stays organized and responsive at every step.

Manage Your Portfolios

Segmenting your accounts into portfolios creates a foundation for more accurate credit performance tracking, focused collection strategies, and proactive risk management. Portfolios can be easily adjusted as market conditions shift, giving you the flexibility to respond quickly to external changes or evolving customer behavior.

Assign each portfolio to team members whose skill sets, experience, and past performance align with the unique demands of that segment.

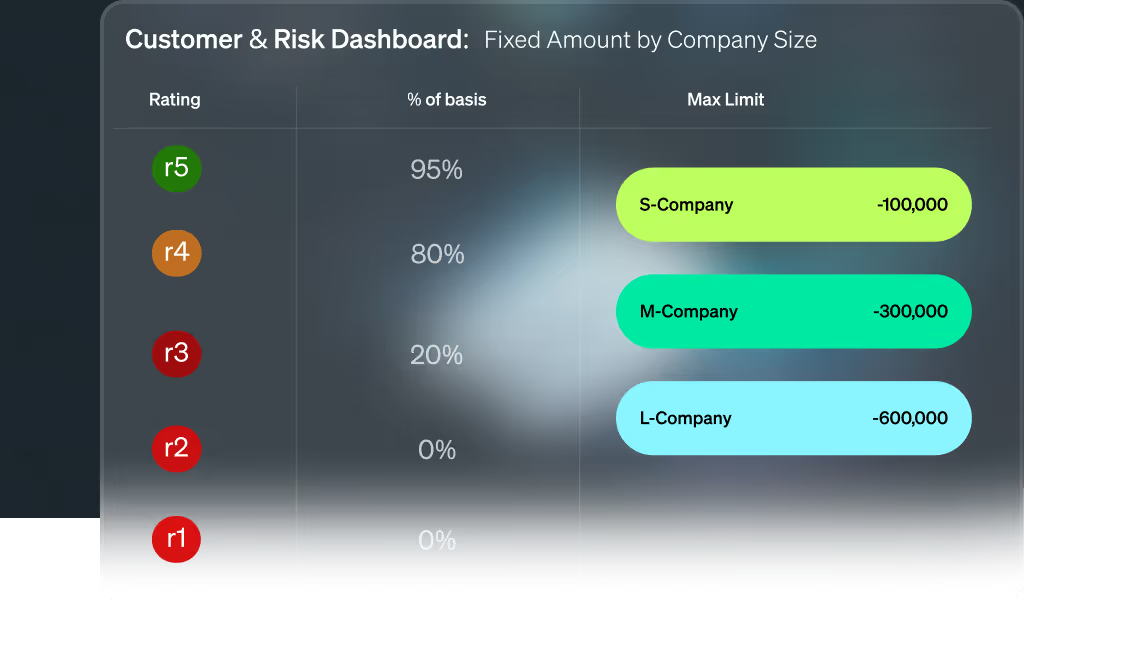

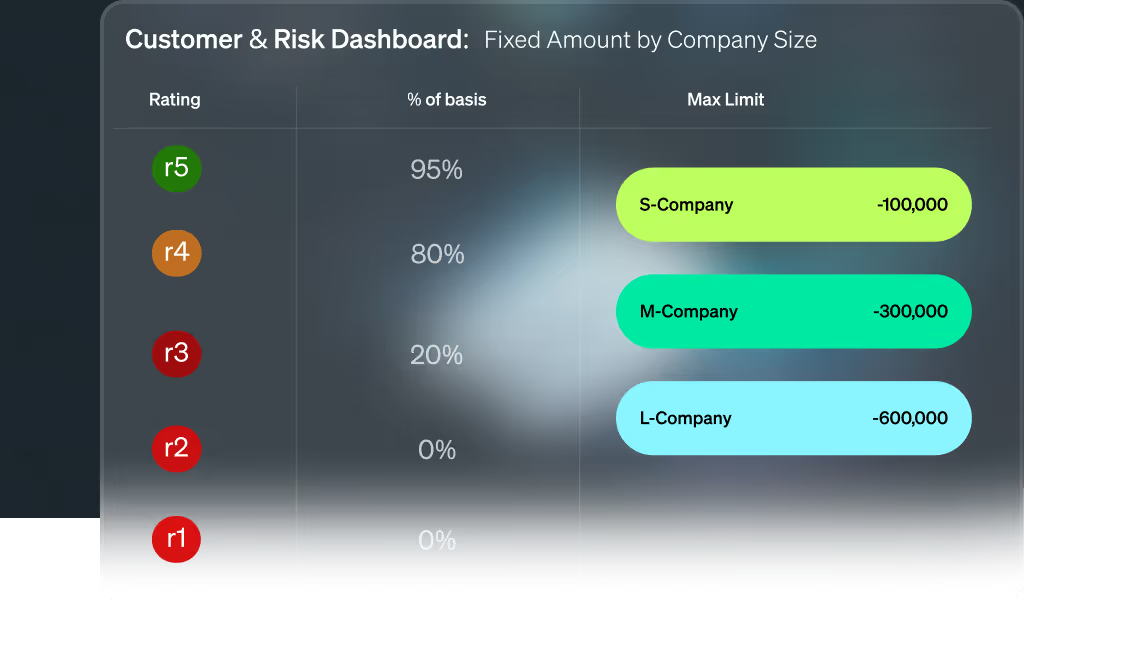

Risk Analysis

Drill down into individual accounts or zoom out to assess risk at the portfolio level.

With integrated analytics and real-time risk scoring, you can proactively monitor and manage risk exposure across your AR operations. Identify emerging concerns before they impact cash flow — such as payment delays, deteriorating financial health, or shifts in credit behavior — and take action before issues escalate.

Organizational Oversight

Compare portfolio outcomes across teams, regions, customer segments, or custom groupings using a wide range of metrics — including DSO, aging trends, credit risk exposure, and collection effectiveness.

Track performance as it happens or over time, with trends viewable by day, week, or month. Quickly spot what’s working, where risk is growing, and how your strategies are shaping results.

Insight That Drives Success.